market insights

Sellers listed more homes (up 47%), saw their homes go under contract faster (median down to 10 days from 25) & did less price reductions (down to 37%)

Buyers, aided by a slight dip in the 30-yr fixed mortgage rate, were ready to pounce but faced competition and multiple offer situations

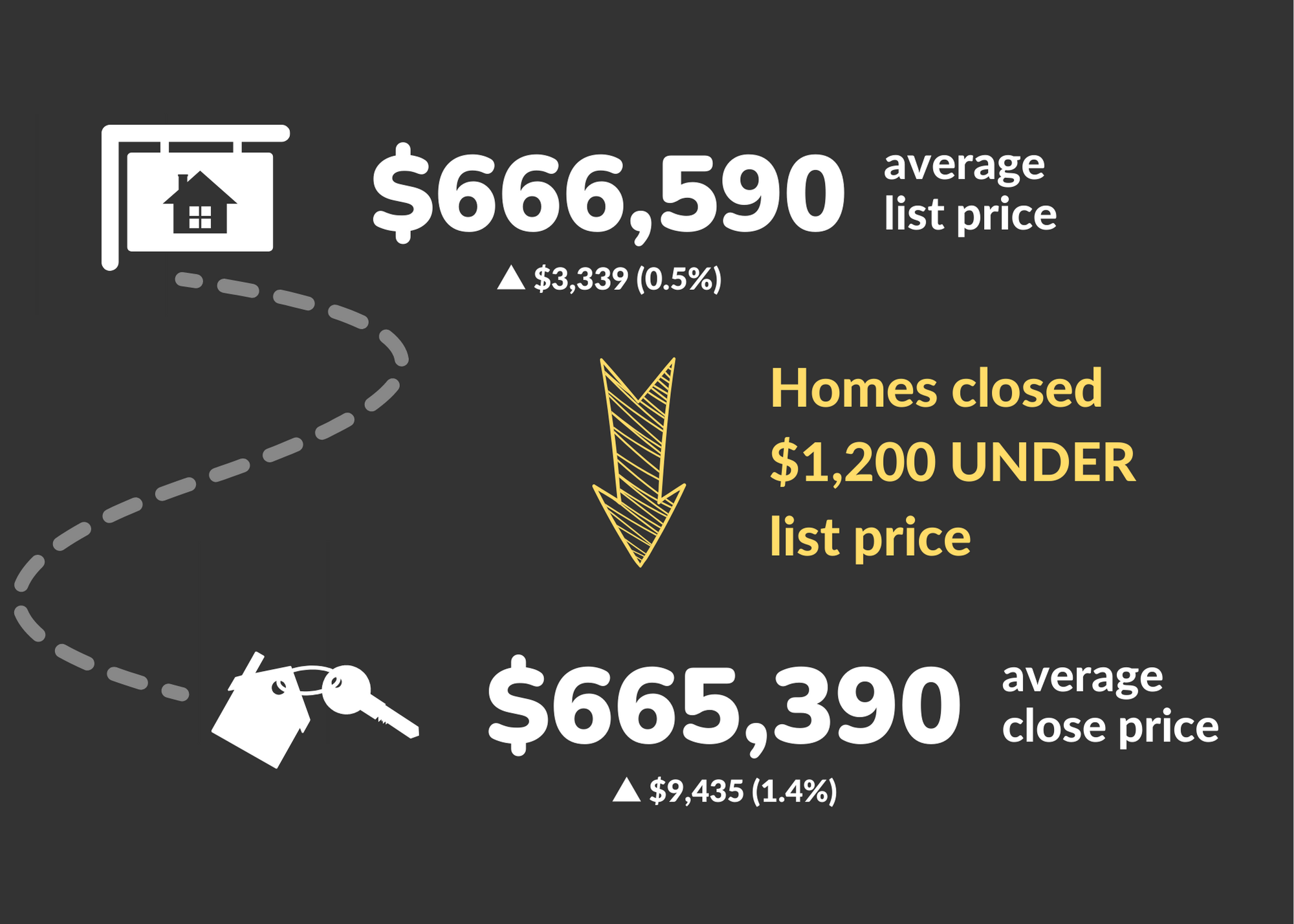

On average, homes closed $1200 under list price, a quickly shrinking gap & one that could flip the other way as soon as this month

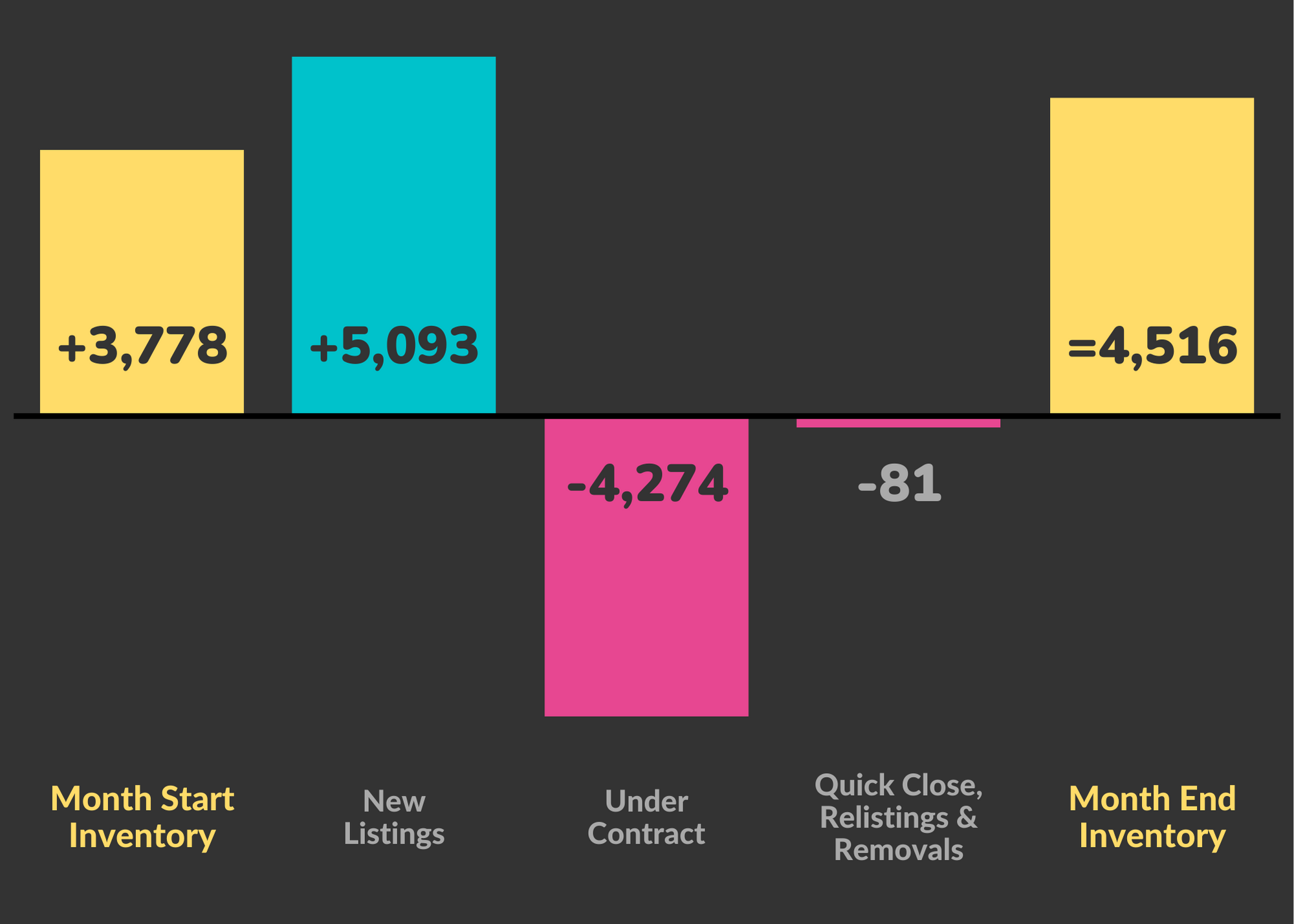

Market activity continued to pick up in March, as Denver Metro saw an inventory bump, but it hasn’t been enough to satisfy the insatiable buyer demand. Let’s break down what that means for buyers and sellers as we move deeper into spring.

Sellers are still calling the shots

While, on average, homes are still closing under list price, the gap continues to shrink and is down to $1,200. I would not be surprised to see that number flip over as soon as next month, with homes closing over list price again. With a mere 1.2 months of inventory, buyers are faced with limited options and stiff competition. Multiple offers will continue to be the norm for now, giving most sellers options to maximize their return.

Price reductions were down to 37%, a significant drop from the 58% we saw in November. Part of this has to do with the demand; a lot of the credit goes to better pricing. Homes that are priced correctly will sell for more in less time.

Patient buyers are ready to jump at the right opportunities, but have competition

An influx of new listings in March (up 47%) coincided with the 30-year fixed mortgage rate dropping to 6.57% from 6.94% (after a 1% bump in February). Many buyers were ready to pounce on these new options and slightly improved rates, increasing homes under contract (up 22%) and homes closed (up 32%).

At the same time, average close price nudged upwards 1.44% while median days on market dropped to 10 days from 25. In other words, more than half of the homes were on the market a full 2 weeks less than the month prior. Buyers who patiently waited through the winter, are moving fast and going strong when they find the right home.

Expect more of the same as spring moves to summer

Between various spring break weeks in March to Easter in early April holding things back a smidge, it is likely the market uptick is only getting started. While this means more available homes on the market, it will not be enough to satisfy the buyer demand. Competition is here to stay for now, though I don’t expect it to be as crazy as last year. Fingers crossed.

Interest rates will continue to play a significant role in how this all plays out. Many homeowners, with interest rates below 5%, are unlikely to sell unless they have to. Buyers, on the other hand, have their buying power impacted with every quarter-percent fluctuation in rates.

Where does that leave you?

What I wrote in this space last month still holds — navigating through it all successfully will come down to knowledge, creativity and lots of patience. This starts with having a great team around you. If you want to learn more about how you can successfully navigate this market, let’s talk.

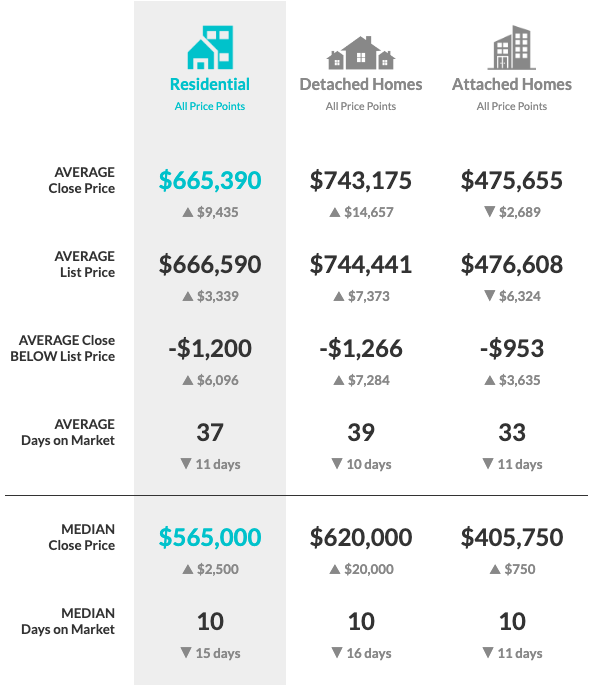

inside the numbers

comparing close price to list

The gap between list & close price shrunk another $6000 as buyer demand remains high with more multiple offer situations on newer inventory

Data source: DMAR Real Estate Market Trends Report. I am member of the DMAR Market Trends Committee that compiles and publishes the report.

The Denver Metro Area encompasses 11 counties: Adams, Arapahoe, Boulder, Broomfield, Clear Creek, Denver, Douglas, Elbert, Gilpin, Jefferson, and Park.

Recent Comments