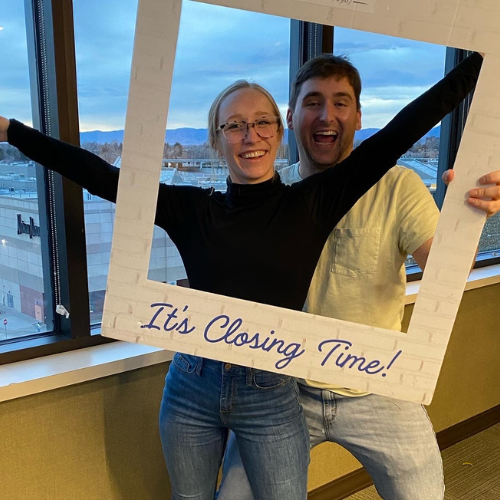

Meet Nick

Trusted advisor, broker, mentor, teacher, market guru, friend – I wear all of these hats and more and with great pride. Helping others through real estate is my passion. I believe in a personalized approach, taking the time up front to get to know you so I can better guide you through your real estate journey.

To “Pick Nick” means you are assured a five-star experience with the best possible strategy, support, education, guidance… anything you need to succeed in real estate.

Pick Nick for Real Estate

Let’s get you started on your real estate journey

Buy with Nick

Find a home that matches your personality & lifestyle with my unique approach that will make you stand out in a crowded field.

List with Nick

My streamlined selling process & extensive market knowledge showcases your home to get you the best possible value.

Partner with Nick

Whether across the state or on the other side of the country, let’s partner together to give our clients a five-star experience.

Testimonials

Work with Nick

My passion for real estate is best expressed through the great people I get to meet every day. I would love for the chance to meet you, hear your story, and see see how I can help you achieve your real estate goals. Click to Pick Nick

©2024 DiPasquale Real Estate LLC - Pick Nick for Real Estate - Your Denver Metro Real Estate Market Expert