market insights

We are moving from a strong seller’s market to a more balanced market as inventory & days on market are up along buyer negotiating power

Homes continued to close on average under list price for the second straight month and for almost double the amount as last month

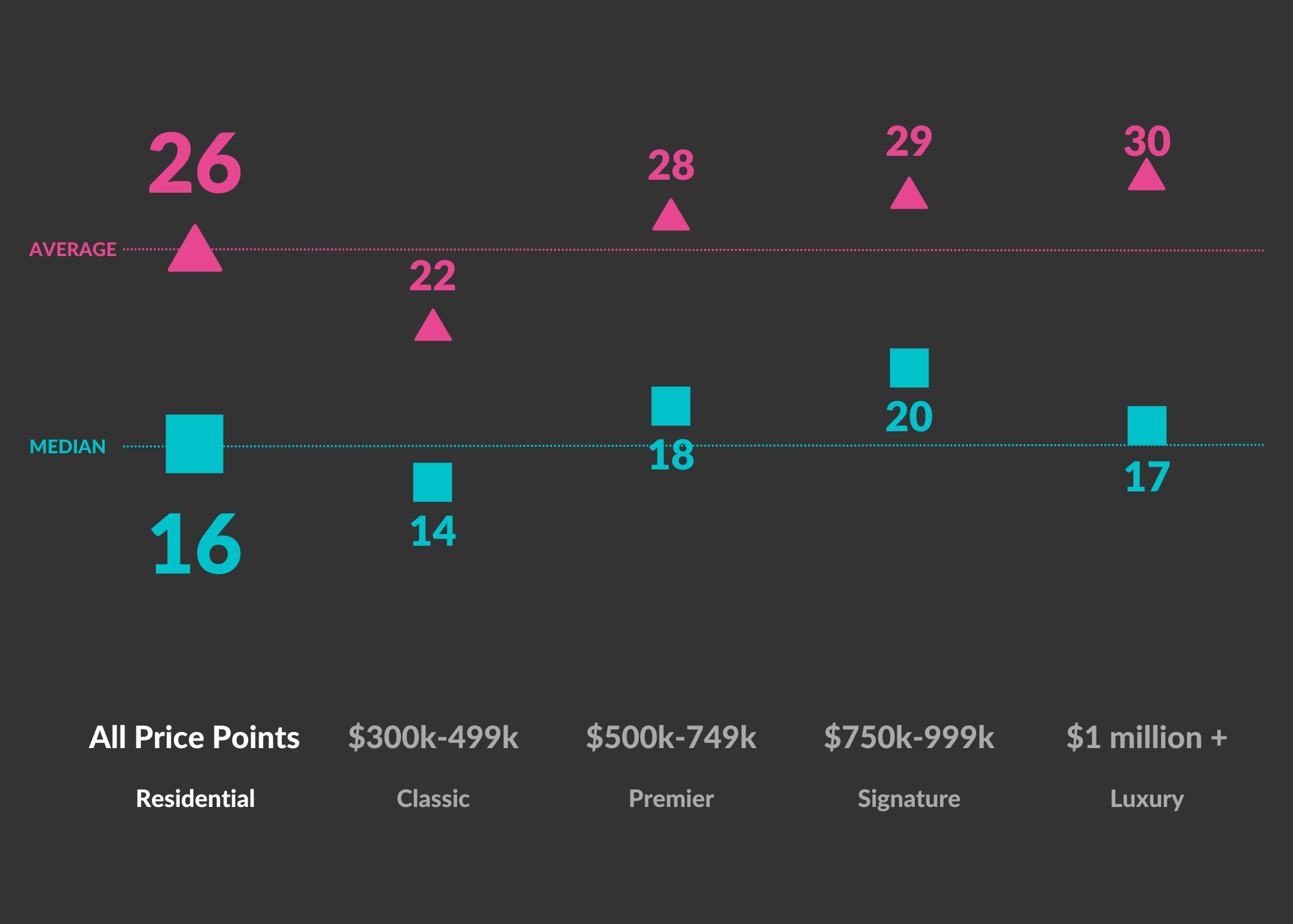

Average days on market was up from 19 to 26 days as were price reductions as sellers & listing agents try to keep pace with a quickly changing market

Things are changing in the market and changing in a way that can’t always be explained in pictures. Going forward, I will use this space to provide deeper analysis into the Denver Metro real estate market. This has always been my intention and there is no better time to start than now.

The bottom line: we have shifted from a strong seller’s market in Denver Metro a few months back to a more balanced market now. How did this happen? And how do we know it’s not just a seasonal shift? Some of that lies in the data and some of that in experience from being out there with clients and other agents.

Diving into the data

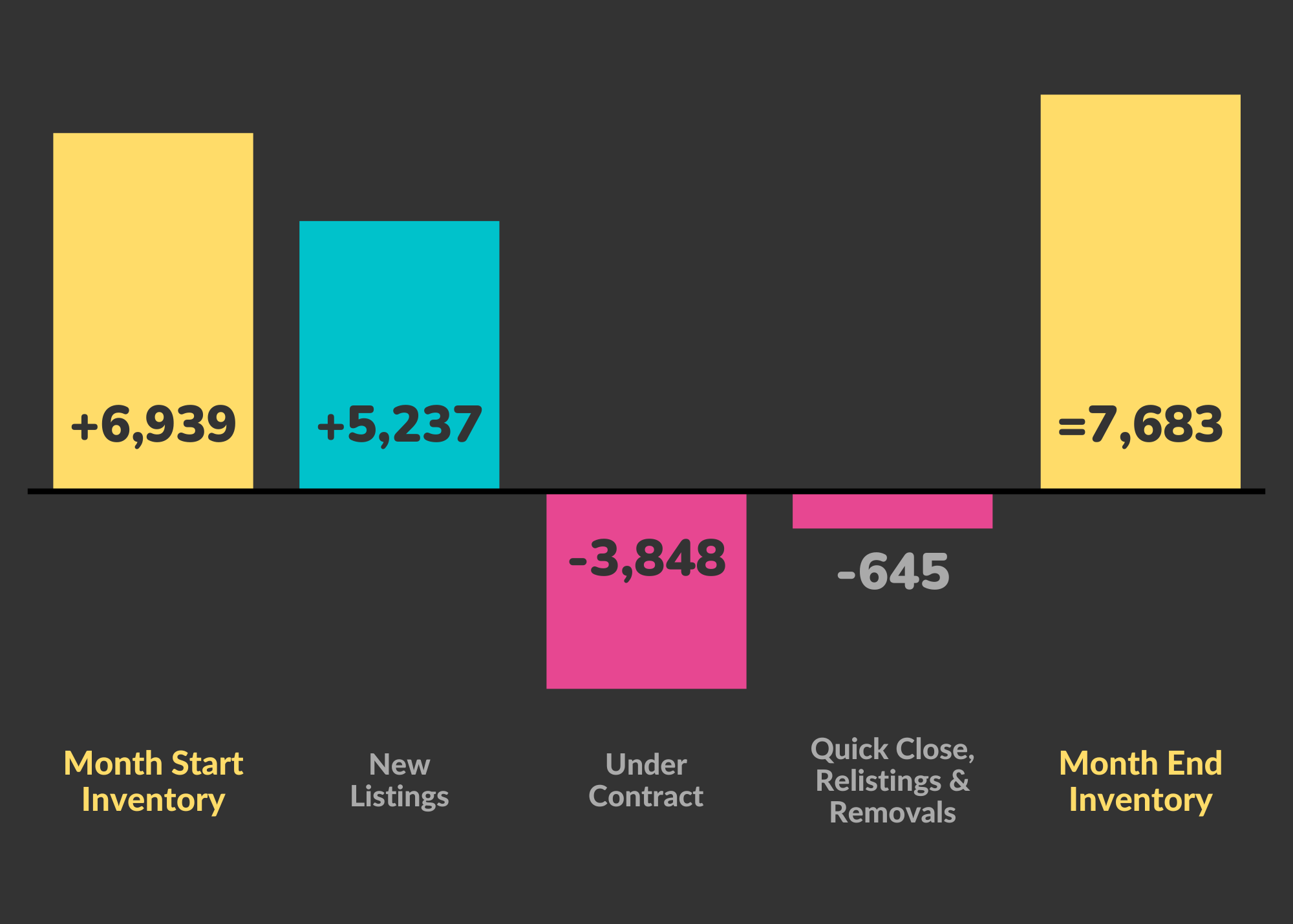

In the past five months alone, available inventory is up 140%, days on market is up 225%, and average close price is down more than $50,000 (a 7% drop). This August was the first month homes closed on average under list price in more than 2 years, a trend that continued in September when homes closed on average $7,400 under list price. Five months ago, homes were closing on average of $46,500 over list price — a $51,000 swing!

That is a huge shift for such a short period of time. You can attribute these changes in part to higher interest rates, the struggling economy, and world unrest. Buyers are proving to be more patient and selective; whereas sellers (and listing agents) haven’t all caught up.

Experiencing the shift firsthand

Sellers can no longer rely on iPhone pictures and throwing a price at a wall to sell a home. We are no longer getting 30+ showings and 10 offers in 2 days. True home marketing is back and along with it comes strategic pricing. Listing agents must be conservative and a little clairvoyant when recent comps are already outdated. This means calling agents who recently sold or went under contract and finding out everything we can to price appropriately.

Buyers writing offers no longer have to waive inspection, offer large appraisal gaps, or throw $50,000+ extra at homes, just in the hopes of going under contract. The rush of having to get in the home first and get the offer in asap is gone. That call mid-showing that the seller just received an offer and your buyers have to decide whether to offer in the next 15 mins… surely will not be missed.

As early as late July when I was getting ready to list at Steeplechase in Littleton, buyers were still anxious about losing out on homes. When I called agents who listed in the area, homes that had sold at the height of the market just a few weeks prior, I heard the same story over and over again: they only had three to five showings and one over list price offer which their sellers took right away. Those offers were over list because of that fear — not because of competition. I ended up listing $30k (almost 10%) under market and several agents, including one that had been on the market three weeks, followed suit and lowered their price down to ours. My seller ended up closing at list price while others sold for even less.

Putting it together

As I dug into the data over the past several months, a very interesting fact jumped out. Even though inventory and days on market were up when average list price was down $50k, homes were being listed higher last month than they were five months ago (up $3,000). What does that mean? Well, in some ways, we are almost doing this to ourselves. There is a stark disconnect between recent pricing and what is happening in the market. It may be several months before that is corrected or it may never be correct before the market picks up in Spring. Time will tell and I will be watching that space. You should too.

Having a solid grasp of the market is so important to providing the absolute best service to anyone looking to buy or sell a home. This may mean difficult conversations with sellers who think they can sell for more than the market is showing or buyers who feel burned by rising interest rates.

While the market has shifted, sellers can still benefit from recent record appreciation, while buyers don’t have to offer weeks at resorts or naming rights of first-born children (both true) or any other crazy incentive to get a home. A welcome middle ground has developed where everyone can benefit.

inside the numbers

days on market by segment

Days on Market climbed another 7 days on average after a similar increase in August — a jump of 2 weeks in 2 months — making more homes available longer

Want to dive further?

Cover photo courtesy of Amanda Rodell. Visit her on Shutterstock at AKRodell or click here.

Data source: DMAR Real Estate Market Trends Report. I am member of the DMAR Market Trends Committee that compiles and publishes the report.

The Denver Metro Area encompasses 11 counties: Adams, Arapahoe, Boulder, Broomfield, Clear Creek, Denver, Douglas, Elbert, Gilpin, Jefferson, and Park.